2024 Q2 Market Commentary

After 2023, during which The Standard and Poor’s 500 (the S&P 500) rallied over 24%, many economists and investment professionals predicted a 2024 in which markets would slow down or even pull back. We are now halfway through the year, and that is definitively not the case. The markets have continued to rally, even in the face of a lot of unknowns.

The most frequently quoted market index is the S&P 500, and in the second quarter it gained almost 4%, bringing the total return for 2024 to 15.3%. This index is comprised of the largest 500 companies traded on stock exchanges in the United States. The percentage of the index that each company comprises is based on the market capitalization (calculated as price per share x number of shares outstanding) of the company. So, the bigger the company, the larger the percentage of the index. With the technology sector’s rapid growth, six tech companies are now the largest in the S&P 500, comprising over 31% of the index.[1] To have only six companies accounting for 31% of the S&P 500 could leave some investors not as diversified as they believe they are.

The S&P 500 is not alone in a strong 2024. The Nasdaq Composite, which is a tech-heavy index, is up 17.5%. Things have not been as strong for the Dow Jones Industrial Average, but it is still up 4.80% year-to-date. Small-cap stocks, as tracked by the Russell 2000 Index, were up only 1.70% in the second quarter but there has been evidence of a turn since the end of June. International stocks have not fared as well as U.S domiciled stocks, returning 5.69% in the first half of the year.[2]

Fixed income (or bonds) has been flat for the first half of the year but started to see a turn in early July as the Federal Reserve (the Fed) continues to hint that they are done with interest rate increases and the next move will be a cut. If this happens, it should have a positive effect on fixed income prices.

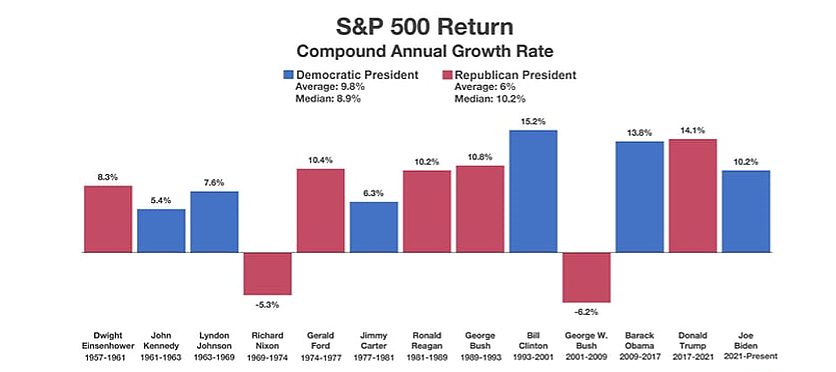

While it has been a great start to the year, there are several events that will need to be watched closely in the second half. There are still two on-going conflicts in Russia and the Middle East. China is suffering its biggest financial downturn in years, which could have a destabilizing effect. While the rate of price increases (inflation) is going down, that is subject to change. Finally, there will be a presidential election in November. While an election cycle generates a lot of news and emotions, once it is over, the market will adjust accordingly and survive. As evidenced by the chart below, the market can go up no matter which party is in the White House.

Data Source: The White House Historical Association, YCharts. The graphic includes S&P 500 performance data through July 3, 2024.[3]

As we move to the second half of the year, it is a good time to review your portfolio to see if it is still allocated to meet your long-term objectives. If you are following a financial plan, as you should be, now might be a time to take gains to match your spending needs in the coming years.

As always, we are here if you want to talk in more detail.

– Will Bowen

The views and opinions expressed are of Persium Advisors, LLC. This commentary is provided for educational purposes only and should not be construed as investment advice. Persium Advisors is an investment advisor firm located in Atlanta, GA.

ph 678.322.3000 / fax 678.322.3059

Persium Group, LLC / 2100 Riveredge Parkway, Suite 1230 / Atlanta, GA 30328

Persium Group consists of three teams: Persium Advisors — wealth management for business owners and other investors, NAVIX — exit planning for business owners, and CoVerity — serving the needs of retirement plan committees.

The Persium Group, formerly known as White Horse, is an independently owned and operated firm that was founded in 2004. In 2010, White Horse Advisors, LLC registered with the Securities and Exchange Commission as an investment adviser allowing us to operate in a product neutral, fee-only investment environment.